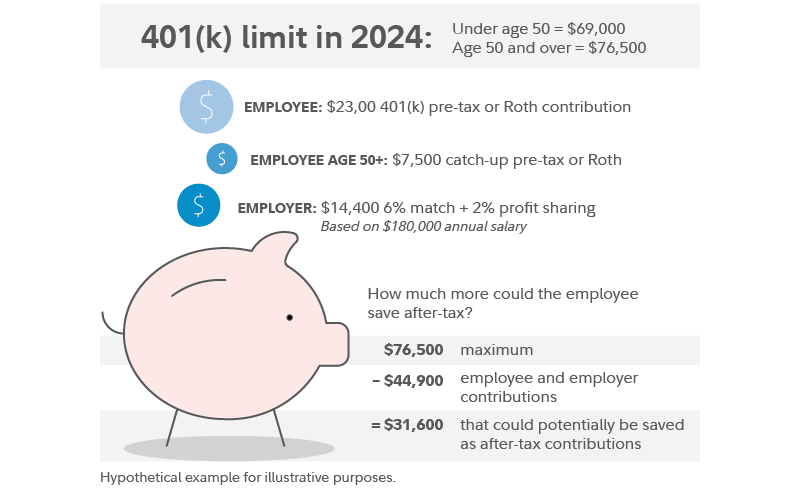

After Tax 401k Contributions 2024 – More help: How to save for retirement with a 401(k) Some 401(k) plans allow employees to make after-tax contributions to reach the combined employee and employer contribution limit. For example . That means a full $30,000 this year, and more if you’re 50 or older: The 401 (k) maximum for 2024 is $23,000 and the IRA maximum is $7,000, and savers who are 50 or older can make additional .

After Tax 401k Contributions 2024

Source : thecollegeinvestor.comThe Mega Backdoor Roth: Too Good to Be True? | RGWM Insights

Source : rgwealth.comHere’s the Latest 401k, IRA and Other Contribution Limits for 2024

Source : theneighborhoodfinanceguy.comAfter tax 401(k) contributions | Retirement benefits | Fidelity

Source : www.fidelity.comNew 2024 IRS Retirement Plan Contribution Limits [Including 401(k

Source : www.whitecoatinvestor.comThe Ultimate Roth 401(k) Guide 2024

Source : districtcapitalmanagement.comContribution Limits Increase for Tax Year 2024 For Traditional

Source : directedira.com401(k) contribution limits 2023 and 2024 | Fidelity

Source : www.fidelity.comThe Ultimate Roth 401(k) Guide 2024

Source : districtcapitalmanagement.comMaking Year 2024 Annual Solo 401k Contributions Pretax, Roth and

Source : www.mysolo401k.netAfter Tax 401k Contributions 2024 401k Contribution Limits For 2024: The higher non-concessional contributions cap means that if you did not trigger the bring-forward rule in the year ended last June 30, 2023 and do not trigger it this financial year, and your TSB is . Retirement account balances hit their highest levels in two years amid improved market conditions and consistent savings rates, according to .

]]>