W-4 Withholding Tables 2024 – The W-4 form is an Employee’s Withholding Allowance Certificate designed to let your employer know how much of your income to withhold for federal taxes. You should fill out a new W-4 when you have . Tax brackets are the government’s way of ensuring that taxpayers who earn more money pay more in taxes. Each bracket consists of a tax rate that’s applied to taxable income within a specific range. .

W-4 Withholding Tables 2024

Source : gusto.comUpdated Income Tax Withholding Tables for 2024: A Guide

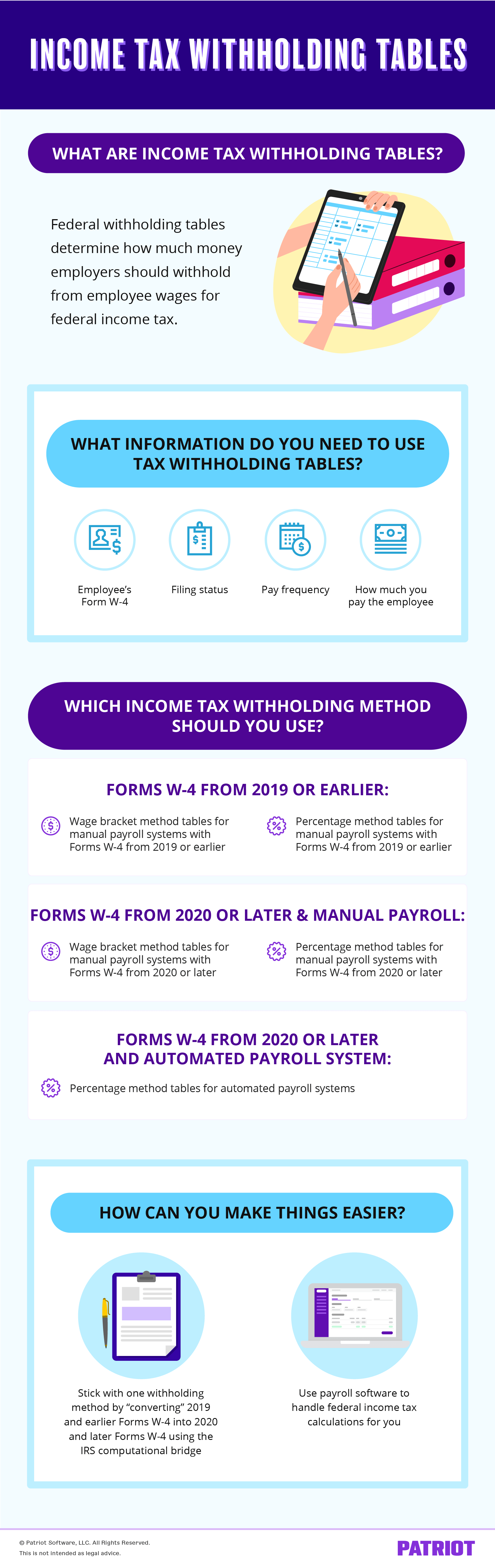

Source : www.patriotsoftware.comPowerChurch Software Church Management Software for Today’s

Source : www.powerchurch.com2024 Publication 15 T

Source : www.irs.govHow To Calculate Your Federal Taxes By Hand · PaycheckCity

Source : www.paycheckcity.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govProjected 2024 Income Tax Brackets CPA Practice Advisor

Source : www.cpapracticeadvisor.comFederal Withholding Tax Tables: 2024 Guide | QuickBooks

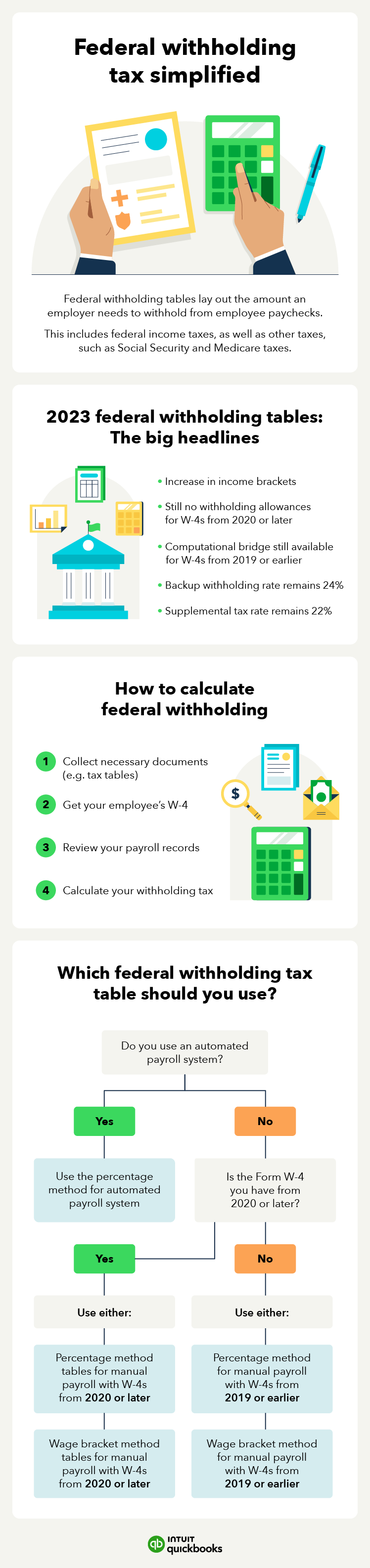

Source : quickbooks.intuit.comUpdated Income Tax Withholding Tables for 2024: A Guide

Source : www.patriotsoftware.comEmployee’s Withholding Certificate

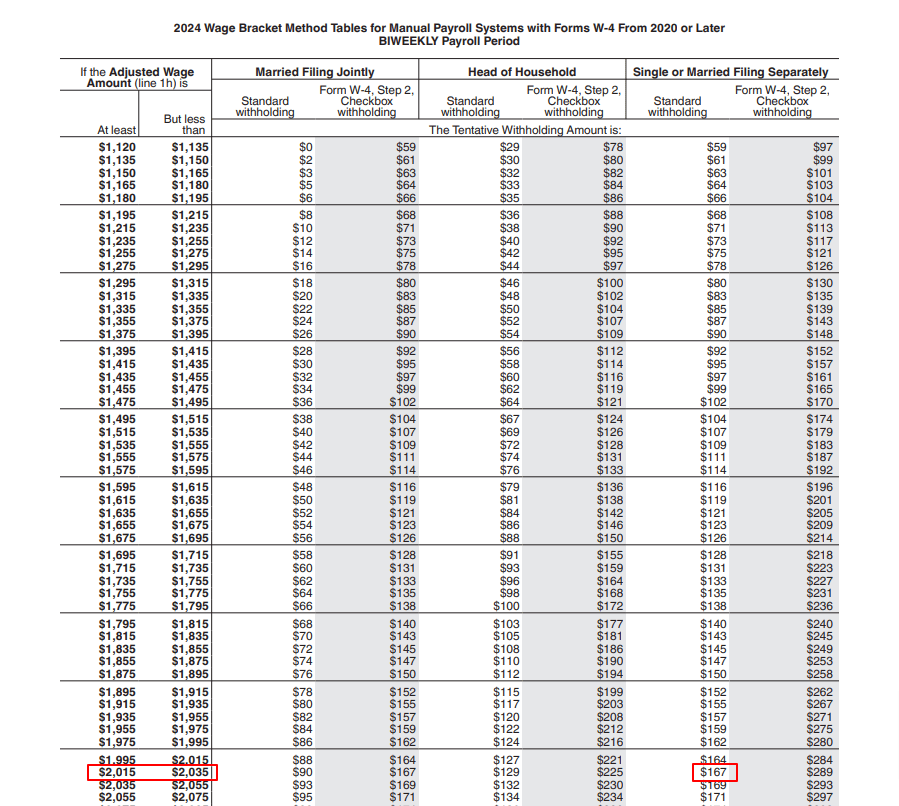

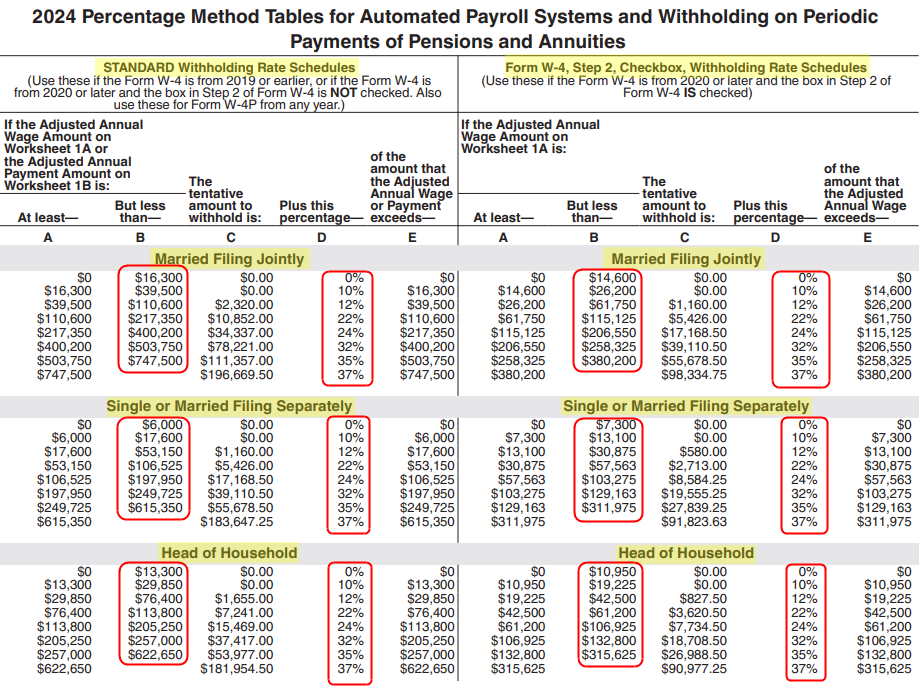

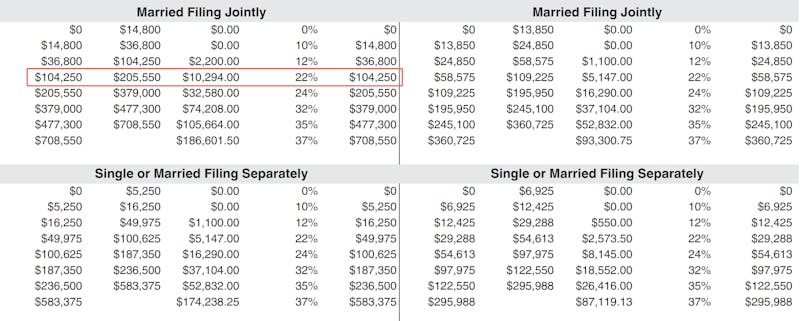

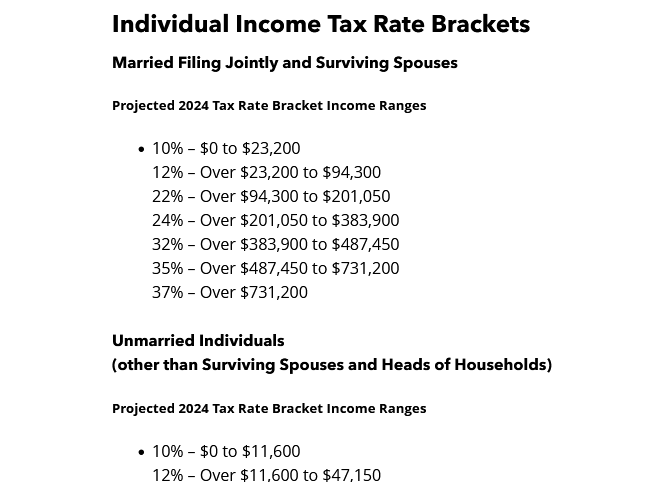

Source : www.irs.govW-4 Withholding Tables 2024 Here’s How to Fill Out the 2024 W 4 Form | Gusto: Don’t be alarmed, on average US tax refunds are 13% lower this year. Here are ways you can receive a bigger one. Peter is a writer and editor for the CNET How-To team. He has been covering . Publication 15-T provides worksheets and tables to figure federal income tax withholding for Forms W-4 from 2019 or earlier and Forms W-4 from 2020 or later. Starting in 2020, the formulas and tables .

]]>